|

|

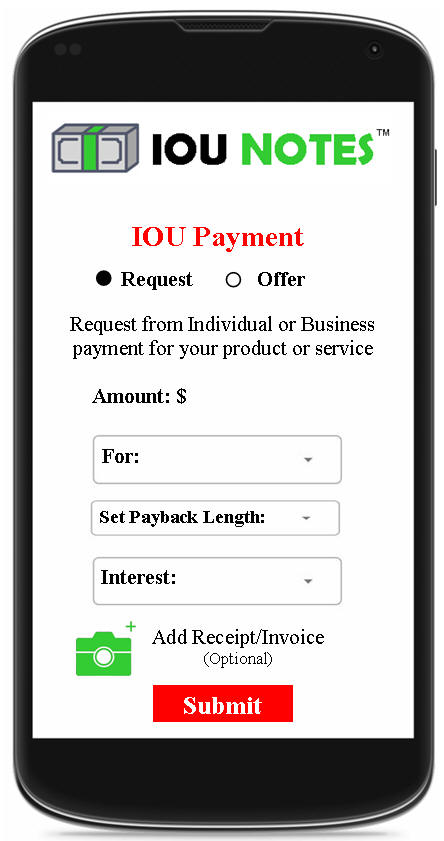

How IOU Notes Works

.

| |

In the modern economy

individuals and businesses pay for products and services using different

forms of payments. These come in the form of a pay now or pay later

method. The IOU (I Owe You) Notes platform focuses on the pay later

method.

Traditional pay now

methods include paper money of that particular government (example, US

Dollar), debit card, check, trade products and services, or bank wire

for larger purchases where the money is changed in real time from buyer

to seller.

Traditional pay later methods include credit cards, installments such as

car payments, mortgages, other loans, and lines of credits for personal

and business use from different institutions.

Another form of

borrowing (pay later method) consists of writing an IOU (I Owe You)

note. This method is where a person borrows money from family, friends,

and others in an informal way. It is with the intention to pay back but

a lot of time either people start asking for the money back, or are too

embarrassed to ask, or the person does not pay back and it creates

tensions in the relationship. Certain businesses also offer to their

client�s forms of credit for their goods or services and clients

generally have 30 days to pay back. These business relationships are

built over many years to establish payment and client history. When an

individual or business starts to try to work with other vendors, that

vendor pulls their credit report to see their history and decides

whether or not to extend credit. Pulling a credit report too often has a

negative effect on that individual or business. This results in making

sense only to ask new vendors for credit on larger types of purchases,

and not small and mid size purchases.

The term

IOU (I Owe You) has a history dating to the 18th century. It is often

viewed as an informal written agreement

acknowledging debt. An IOU between two people conducting business

may be followed up with a more formal written agreement. There is no

standard format for an IOU. Criteria such as repayment terms, time of

payment, interest due, and payment type may or may not be included.

An example of an IOU in

the marketplace is as follows. Say ABC Construction Company places an

order for lumber and other building materials and does not have enough

in payment (credit card, cash, check) to pay for the entire order when

it is delivered. Instead, company pays a down payment and issues an IOU

(I Owe You) promising to pay for the rest of the materials within 30

days with or without interest. Assuming that supplier is ok with this

and has an established business relationship with ABC Construction

Company, an IOU will be accepted by both parties.

There are many

situations where individuals and businesses need to borrow money to

either pay for immediate expenses (food, rent/mortgage, child expenses,

family expenses, etc.) or business expenses (payroll, inventory,

supplies, etc.). Current options to borrow are from banking and lending

institutions who charge high interest rates. Some credit cards offer

zero or low interest rates for a time period but then afterwards

interest rates spike up as much as 29% APR (annual percentage rate) plus

late and other fees. These credit cards companies lure people into their

trap knowing that there will be many people who fall into this interest

trap. Once in debt it is hard to get out. IOU Notes platform interest

rate is set by users (from no interest - 5% max).

People have been

providing credit, borrowing, and lending to each other since the

beginning of time. While this concept is not new, IOU Notes created a

platform (patent pending) where transactions can safety and easily take

place, be tracked, etc. in one convenient platform. Every account

created must be a real person or business entity and go through a

verification process by uploading the proper form of identification.

Profiles can be set to public where everyone can see or private mode so

just the individuals and businesses that are working together can see.

|

|

|

|

|

Our Story and Mission

IOU Notes™

is an Financial Technology Company

based in South Florida. Our mission is to empower all individuals,

families, and businesses with financial freedom and to leverage

their inherent rights.

Before banks and

other financial institutions told us our worth and decided our

credit limits, individuals, families, and businesses made agreements

and it was backed by their word, which was as good as a contract. As

time passed and things changed, the standard practice changed to

contracts and other methods were established.

These days Financial Institutions (Banks, Credit Unions,

Lenders) and Larger Companies who have the resources,

provide credit and/or loans to others. This relates to

these institutions decide the terms which equals

to higher interest rates as high as 29%

APR plus late and other fees.

Payday

loan APRs can total 400% or more when you factor in all the

fees and interest. IOU Notes platform interest rate

is set by users (from no interest - 5% max.

IOU Notes is here to

put the power into those hands of the masses. With the IOU Notes

platform every person

is their own bank. The platform extends money creation and

generating new money into the economy abilities to all people and

businesses in every country (currently available only in US)

regardless of their background, gender, race, religion, political

affiliation, economic status, education, income level, or any other

factors.

.png)

.png)

|

|